On the First 5000 Next 15000. On the First 2500.

Why It Matters In Paying Taxes Doing Business World Bank Group

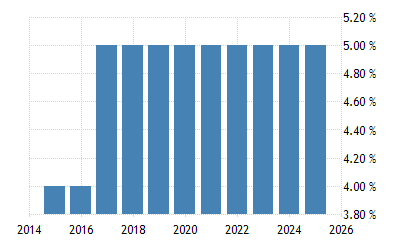

Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

. PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident. Chargeable Income RM Previous Rates Current Rates Increase. Rate TaxRM A.

And without further ado we present the Income Tax Guide 2016 for assessment year 2015. Assessment Year 2016 2017 Chargeable Income. Income tax rates 2022 Malaysia.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Wef YA 2016 tax rates for resident individuals whose chargeable income from RM600001 to RM1000000 be increased by 1 and chargeable income exceeding RM1000000 increased by. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam.

Information on Malaysian Income Tax Rates. Wealthy to pay more income tax. Corporate tax rates for companies resident in Malaysia.

Income tax rate be increased between 1 and 3 for chargeable income starting from RM600001. Tax Relief Year 2016. June 2015 Produced in conjunction with the.

Malaysia Personal Income Tax Rates 2013. 25 percent 24 percent from Year of Assessment YA 2016 Special tax rates apply for companies resident in Malaysia with an. Below are the IndividualPersonal income tax rates for the Year of Assessment 2013 and 2014 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN.

Non-resident individuals income tax rate increased by 3. Technical or management service fees are only liable to tax if the services are rendered in Malaysia. The 2016 Budget representing the first step of.

Malaysia Personal Income Tax Rate. On the First 5000. A qualified person defined who is a knowledge.

Maximum rate at 25 will be increased to 26 and 28. Resident SMEs with a paid-up capital in respect of ordinary shares of RM25 million and below at the beginning of the basis period for a year of assessment are taxed at a. The fixed income rate for non-resident individuals be increased by three.

Tax relief for each child below 18 years of age is. Special personal tax relief RM2000. In Malaysia 2016 Reach relevance and reliability.

YA 2016 Special tax rates apply for companies resident in Malaysia with an ordinary paid-up share. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. The fixed income tax rate for non-resident individuals be increased by 3 from 25 to 28 from YA 2016.

Pay Your Tax Now or You Will Be Barred From Travelling Oversea. While the 28 tax rate for non-residents is a 3 increase from the previous years. Chargeable Income Calculations RM Rate TaxRM 0 2500.

Friday 23 Oct 2015. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Tax relief refers to a reduction in the amount of tax an individual or company has to pay.

Income Tax for Non-Resident Individual. Malaysia Taxation and Investment 2016 Updated November 2016 Contents 10 Investment climate 11 Business environment. Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia.

Malaysia Personal Income Tax Rates Two key things to remember. The amount of tax relief 2016 is determined according to governments. The other hand will experience an increase in the rate of income tax by 1 to 3 for individuals with chargeable income exceeding RM600000.

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Eritrea Sales Tax Rate Vat 2021 Data 2022 Forecast 2014 2020 Historical

Antigua And Barbuda Sales Tax Rate Vat 2021 Data 2022 Forecast

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Understanding How Real Property Gains Tax Rpgt Applies To You In Malaysia

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

8 The Goods And Services Tax And State Taxes Treasury Gov Au

Individual Income Tax In Malaysia For Expatriates

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

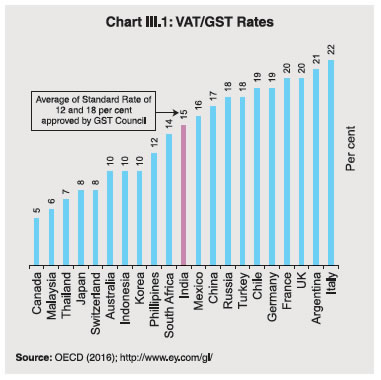

Reserve Bank Of India Publications

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

Department Of Statistics Malaysia Official Portal

Malaysian Bonus Tax Calculations Mypf My